Fintech in the USA: Complete Guide to the American Financial Technology Ecosystem

The United States stands at the forefront of global fintech innovation, with Silicon Valley, New York, and emerging hubs driving financial technology transformation. This comprehensive guide explores the US fintech landscape, key players, regulatory environment, and opportunities for innovation.

US Fintech Overview

Market Landscape

The US leads global fintech innovation.

Key Statistics:

| Metric | Value |

|---|---|

| Fintech companies | 10,000+ |

| Fintech unicorns | 100+ |

| Total investment (2023) | $20B+ |

| Employment | 1.5M+ |

| Global market share | 45%+ |

Industry Structure

US fintech ecosystem composition.

Market Segments:

US Fintech Ecosystem:

├── Payments

│ ├── Digital wallets

│ ├── Payment processing

│ ├── B2B payments

│ └── Cross-border

├── Lending

│ ├── Consumer lending

│ ├── Mortgage tech

│ ├── SMB lending

│ └── BNPL

├── Wealth Management

│ ├── Robo-advisors

│ ├── Trading platforms

│ ├── Crypto exchanges

│ └── Alternative investments

├── Banking

│ ├── Neo-banks

│ ├── Banking-as-a-Service

│ └── Embedded finance

└── Infrastructure

├── Core banking

├── Identity verification

└── Compliance tech

Regulatory Environment

Federal Oversight

Multi-agency regulatory landscape.

Key Regulators:

| Agency | Jurisdiction |

|---|---|

| OCC | National banks, federal thrifts |

| Federal Reserve | Bank holding companies |

| FDIC | Deposit insurance |

| CFPB | Consumer protection |

| SEC | Securities, investment advisors |

| FinCEN | AML/BSA compliance |

| CFTC | Derivatives, commodities |

State Regulations

State-level compliance requirements.

State Considerations:

- Money transmitter licenses

- Lending licenses

- Insurance licenses

- State consumer protection

- BitLicense (New York)

- State sandbox programs

Regulatory Framework

Compliance requirements overview.

Key Regulations:

Regulatory Landscape:

├── Consumer Protection

│ ├── Truth in Lending Act (TILA)

│ ├── Electronic Fund Transfer Act

│ ├── Fair Credit Reporting Act

│ └── Equal Credit Opportunity Act

├── Anti-Money Laundering

│ ├── Bank Secrecy Act

│ ├── USA PATRIOT Act

│ ├── Customer Due Diligence

│ └── Suspicious Activity Reporting

├── Data Privacy

│ ├── Gramm-Leach-Bliley Act

│ ├── CCPA (California)

│ ├── State privacy laws

│ └── Industry standards

└── Securities

├── Securities Act

├── Investment Advisers Act

├── Regulation D

└── Regulation CF

Digital Payments

Payment Innovation

US payment technology leadership.

Payment Landscape:

| Category | Key Players | Market Share |

|---|---|---|

| Card networks | Visa, Mastercard | 80%+ |

| Mobile wallets | Apple Pay, Google Pay | 45%+ adoption |

| Payment processors | Stripe, Square | Growing |

| P2P payments | Venmo, Zelle, Cash App | 100M+ users |

| BNPL | Affirm, Klarna, Afterpay | 40%+ growth |

Real-Time Payments

Instant payment infrastructure.

Payment Rails:

US Payment Infrastructure:

├── Card Networks

│ ├── Visa

│ ├── Mastercard

│ ├── American Express

│ └── Discover

├── ACH Network

│ ├── Same-day ACH

│ ├── Next-day ACH

│ └── NACHA rules

├── Real-Time Payments

│ ├── RTP Network (The Clearing House)

│ ├── FedNow (Federal Reserve)

│ └── Zelle

└── Alternative Rails

├── Crypto rails

├── Stablecoins

└── Cross-border networks

Buy Now Pay Later

BNPL market transformation.

BNPL Ecosystem:

- Affirm - E-commerce BNPL

- Klarna - Global BNPL leader

- Afterpay/Block - Consumer BNPL

- PayPal Pay Later - Integrated BNPL

- Apple Pay Later - Tech ecosystem BNPL

Digital Banking

Neo-Banks

Digital-first banking platforms.

Leading Neo-Banks:

| Company | Focus | Users |

|---|---|---|

| Chime | Consumer banking | 14M+ |

| Dave | Overdraft alternatives | 12M+ |

| Current | Teen/family banking | 4M+ |

| Varo | Full-service digital bank | 7M+ |

| SoFi | Financial services platform | 6M+ |

| MoneyLion | Wealth + lending | 9M+ |

Banking-as-a-Service

Infrastructure enabling embedded finance.

BaaS Providers:

BaaS Ecosystem:

├── Infrastructure Providers

│ ├── Synapse

│ ├── Galileo

│ ├── Marqeta

│ └── Unit

├── Sponsor Banks

│ ├── Cross River Bank

│ ├── The Bancorp

│ ├── Evolve Bank

│ └── Blue Ridge Bank

└── Use Cases

├── Embedded accounts

├── Branded cards

├── Lending programs

└── Payments integration

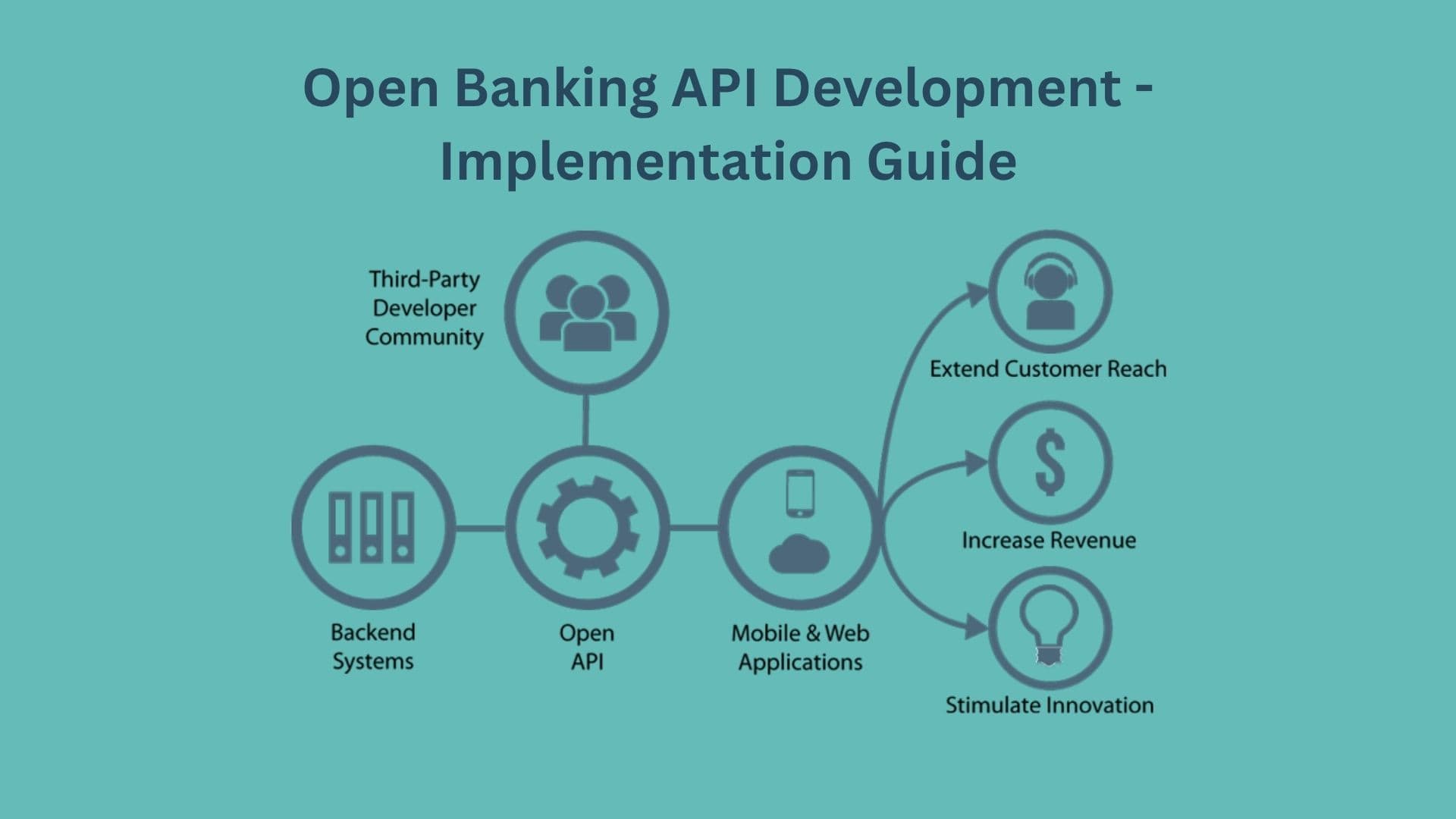

Open Banking

API-driven financial services.

Open Banking Trends:

- Consumer data rights

- API aggregation (Plaid, Yodlee)

- Screen scraping challenges

- CFPB 1033 rulemaking

- Bank API adoption

- Third-party access

Lending Technology

Digital Lending Platforms

Alternative lending ecosystem.

Lending Categories:

| Type | Description | Examples |

|---|---|---|

| Consumer loans | Personal lending | Upstart, LendingClub |

| Mortgage tech | Home loans | Rocket Mortgage, Better |

| SMB lending | Business finance | Kabbage, OnDeck |

| Student loans | Education finance | SoFi, Earnest |

| Auto lending | Vehicle finance | Carvana, Ally |

| BNPL | Point-of-sale credit | Affirm, Klarna |

Credit Innovation

Modern credit assessment.

Credit Trends:

Lending Innovation:

├── Alternative Data

│ ├── Cash flow underwriting

│ ├── Employment verification

│ ├── Rent/utility payments

│ └── Bank transaction analysis

├── AI/ML Models

│ ├── Credit risk assessment

│ ├── Fraud detection

│ ├── Default prediction

│ └── Collection optimization

├── Process Automation

│ ├── Instant decisioning

│ ├── Digital verification

│ ├── E-closing

│ └── Automated servicing

└── New Products

├── Earned wage access

├── Subscription financing

├── Embedded lending

└── Crypto-backed loans

Wealth Management

Robo-Advisors

Automated investment platforms.

Leading Platforms:

| Platform | AUM | Minimum |

|---|---|---|

| Betterment | $33B+ | $0 |

| Wealthfront | $27B+ | $500 |

| Schwab Intelligent | $70B+ | $5,000 |

| Fidelity Go | $15B+ | $0 |

| Vanguard Digital | $200B+ | $3,000 |

| Personal Capital | $21B+ | $100,000 |

Trading Platforms

Retail investment apps.

Trading Innovation:

- Commission-free trading (Robinhood)

- Fractional shares

- Crypto trading integration

- Social investing features

- Options democratization

- Extended hours trading

Alternative Investments

Access to non-traditional assets.

Alternative Platforms:

Alternative Investment Access:

├── Real Estate

│ ├── Fundrise

│ ├── RealtyMogul

│ └── CrowdStreet

├── Private Equity

│ ├── Moonfare

│ ├── EquityZen

│ └── Forge

├── Collectibles

│ ├── Rally

│ ├── Masterworks

│ └── Otis

└── Venture Capital

├── AngelList

├── Republic

└── SeedInvest

Cryptocurrency and Blockchain

Crypto Ecosystem

US digital asset landscape.

Crypto Categories:

| Type | Examples | Regulation |

|---|---|---|

| Exchanges | Coinbase, Kraken | MSB, State licenses |

| Custody | Anchorage, BitGo | OCC trust charters |

| Stablecoins | USDC, USDT | Emerging regulation |

| DeFi | Uniswap, Aave | Uncertain status |

| NFTs | OpenSea, Rarible | Evolving guidance |

Regulatory Landscape

Crypto regulation in the US.

Regulatory Framework:

Crypto Regulation:

├── Federal Agencies

│ ├── SEC (Securities)

│ ├── CFTC (Commodities)

│ ├── FinCEN (AML)

│ └── IRS (Tax)

├── State Level

│ ├── NY BitLicense

│ ├── MTL requirements

│ └── State-specific rules

└── Industry Standards

├── Self-regulatory orgs

├── Industry best practices

└── Audit standards

Enterprise Blockchain

Blockchain in financial services.

Use Cases:

- Trade finance

- Cross-border payments

- Securities settlement

- Identity verification

- Supply chain finance

- Digital asset custody

Insurtech

Insurance Technology

Digital insurance innovation.

Insurtech Categories:

| Type | Description | Examples |

|---|---|---|

| Digital carriers | Tech-first insurers | Lemonade, Root |

| Distribution | Online brokers | Policygenius, Gabi |

| Claims tech | Automation | Tractable, Hi Marley |

| Commercial | Business insurance | Next Insurance, Pie |

| Embedded | Point-of-sale | Cover Genius |

Innovation Trends

Insurance technology evolution.

Key Trends:

- Usage-based insurance

- AI claims processing

- Parametric insurance

- Embedded insurance

- Cyber insurance growth

- Climate risk modeling

Regtech

Compliance Technology

Regulatory technology solutions.

Regtech Categories:

Regtech Solutions:

├── Identity Verification

│ ├── Jumio

│ ├── Socure

│ ├── Onfido

│ └── Alloy

├── AML/KYC

│ ├── Chainalysis

│ ├── Elliptic

│ ├── ComplyAdvantage

│ └── NICE Actimize

├── Risk Management

│ ├── Quantexa

│ ├── SAS

│ └── Moody's Analytics

└── Reporting

├── Workiva

├── Wolters Kluwer

└── AxiomSL

Fintech Hubs

Silicon Valley

West Coast innovation center.

Silicon Valley Ecosystem:

- Major tech company fintech divisions

- Venture capital concentration

- Stanford/Berkeley talent

- Payment company headquarters

- Crypto/blockchain focus

New York

Financial services capital.

NYC Strengths:

- Wall Street proximity

- Traditional finance talent

- Regulatory relationships

- B2B fintech focus

- Insurance tech hub

Emerging Hubs

Growing fintech centers.

Other Markets:

| City | Focus Area |

|---|---|

| Miami | Crypto, LatAm |

| Austin | Consumer fintech |

| Charlotte | Banking tech |

| Chicago | Trading, payments |

| Boston | Wealthtech |

Investment Landscape

Funding Trends

Capital flowing to US fintech.

Investment Data:

| Year | Funding | Deals |

|---|---|---|

| 2020 | $22B | 850+ |

| 2021 | $52B | 1,200+ |

| 2022 | $28B | 900+ |

| 2023 | $20B | 700+ |

Key Investors

Active fintech investors.

Investor Categories:

Fintech Investors:

├── Venture Capital

│ ├── Andreessen Horowitz (a16z)

│ ├── Ribbit Capital

│ ├── QED Investors

│ ├── Index Ventures

│ └── Bessemer Venture Partners

├── Growth Equity

│ ├── Tiger Global

│ ├── Coatue

│ ├── D1 Capital

│ └── General Atlantic

└── Corporate VCs

├── Goldman Sachs

├── JPMorgan

├── Visa Ventures

└── Mastercard

Challenges and Opportunities

Market Challenges

Obstacles in US fintech.

Key Challenges:

- Regulatory fragmentation

- State-by-state licensing

- Bank partnership dependencies

- Customer acquisition costs

- Profitability pressure

- Competition intensity

Growth Opportunities

Areas for expansion.

Opportunities:

Growth Areas:

├── Underserved Segments

│ ├── Underbanked populations

│ ├── Small businesses

│ ├── Gig economy workers

│ └── Rural communities

├── Technology Trends

│ ├── AI/ML applications

│ ├── Embedded finance

│ ├── Open banking

│ └── Real-time payments

├── Product Innovation

│ ├── Climate fintech

│ ├── Healthcare payments

│ ├── Creator economy

│ └── Web3 integration

└── Market Expansion

├── Cross-border services

├── B2B2C models

└── Enterprise fintech

Working with Innoworks

At Innoworks Software Solutions, we help fintech companies build innovative solutions for the US market.

Our Fintech Services

Development:

- Payment platform development

- Banking integrations

- Compliance systems

- Mobile app development

- API development

Consulting:

- Technology architecture

- Security assessment

- Compliance guidance

- Scalability planning

Conclusion

The US fintech ecosystem continues to lead global financial innovation, with mature infrastructure, abundant capital, and a culture of disruption. From payments to lending to wealth management, American fintech companies are transforming how consumers and businesses manage money.

Success requires navigating complex regulations, building strategic partnerships, and delivering genuine value. Partner with experienced fintech developers like Innoworks to build innovative financial technology solutions for the US market.

Ready to build fintech solutions for the US market? Contact Innoworks to discuss how we can help you develop cutting-edge financial technology applications.